The vexed question of TUPE and Companies in Administration

Paul McConville’s fantastic posts on the Rangers saga from the scotslawthoughts website can be viewed here. One of the more puzzling aspects of this entire story are the TUPE regulations and how they affect the Rangers players that want to leave oldco instead of transferring to Sevco.

Normally when a company purchases another company, TUPE regulations affect the employees to ensure the same contractual rights are established for employees moving from one company to another. If I am employed on 50K a year at Company A, then under TUPE when Company B buys Company A, I am generally speaking, ensured two things – a) my job, b) the same salary and other contractual rights.

For example, if I chose to stay on at Company B I would automatically transfer to the new company. There is no doubt about this.

However, Rangers situation is a bit different. It is in administration, each day closer to liquidation. Administration can be referred to sometimes as a Non-terminal proceeding. These are treated differently than other insolvency procedures. If the liquidators were selling my company to a new purchaser, my rights has an employee, if I choose, automatically transfer to the purchasing company.

In either scenario, I can “object” or “resign“. These words used in this context have specific legal meanings. If I didn’t want to transfer, I can”object” to my transfer. My employment would be terminated without consequence, but I would not able to cash in on any rights or statutory protections. It not treated as a dismissal in the sense of what you and I would call a normal dismissal, but there would never be any compensation.

Resigning is different from objecting. It may be in my interest to resign if there has been major and substantial changes to my contract terms at the purchasing company. I am able to claim statutory protections arguing unfair dismissal.

The Rangers story is a little different though. Rangers are still in administration, not liquidation. Yet. What happens when a company goes into administration? The company’s affairs are handed over to administrators. They run the day-to-day affairs of the business. However, when a company goes into liquidation, liquidators sells a business or the assets or both. In this scenario, neither the liquidator nor the purchaser need worry about employees transferring under TUPE because reg.8(7) dis-applies the relevant parts of the Regulations.

The contentious issue is whether or not a business sold by an administrator is also exempt in the same way. Existing case law had previously suggested that were the ultimate objective of the administrator to liquidate the business following a brief period of trading, TUPE would not apply because the administration was “analogous” to insolvency proceedings (Oakland v Wellswood (Yorkshire) Ltd). This has now been refuted by the Court of Appeal in Key2Law (Paul McConville writes extensively about this in his blog),which ruled that reg.8(7) of TUPE does apply in administration; therefore, employees will be transferred to the purchaser under TUPE when the seller is in administration if they choose to go.

In the present fiasco that is known as the Rangers Football Club, the first practical implication for Charles Green’s Sevco is this – The newco purchased the assets and business of RFC from the administrators, Duff & Phelps. Therefore, he should have been able to expect any employees that chose to move over to come with their terms and conditions of employment protected under TUPE. This point does not seem to be arguable. Therefore, players would have had the right to be consulted prior to the transfer and if this did not take place (this is the point that appears to be argued over) they will be able to claim protective awards after the fact. At least the position is certain, for the time being. It doesn’t in any way suggest that the players MUST go over. They can either object or resign.

In the real world the problem is that purchases from administrators are often “shotgun fashion“, with the administrator anxious to achieve a quick sale and the purchaser just as eager to pick up a cheap asset. In this case Charles Green picking up the players on the cheap. Normally when there is a slow process of sales, the purchaser and seller has time to undertake the usual TUPE consultations.

When Mr Green tried to do is pull a fast one on his players. When he says, “The transfer of contracts has already happened and the club’s clear legal advice is that players’ purported objection is ineffective. Rangers would like to make it abundantly clear to players, agents and the chairmen and managers of other football clubs that we will take whatever steps necessary to challenge what we regard as a breach of contract to protect the interests of our club.”

Yet in reality in a business sense, administrators are often “trigger happy” when it comes to dismissals. This is the purpose of TUPE. After all the objective of administrators is to shed liabilities and to sell any assets or business as quickly as possible, so the scope for claims of unfair dismissal for reasons connected with the transfer, and protective awards, is hugely enhanced. When a purchaser buys assets from administrators, the risk is very high and now even more so as a result administrators of the Key2Law decision as the previous “escape route” provided by Oakland is no longer available.

Thus with Rangers, the issues around transfer of players seems to revolve around whether or not D&P has sufficient time to consult all employees under TUPE. Short of going through the full and proper TUPE consultations, there is no remedy for this. The result is increased protection for employees and discouragement to buyers who will now be less willing to purchase assets from a company in administration.

For a business, the focus must be on carrying out the usual full TUPE consultations (if possible) when purchasing from an administrator. Outside of this Charles Green will have very little protection against what TUPE protects – the employee, unless it is possible for him to argue that TUPE does not apply on some other ground. He would have to successfully argue, that no actual undertaking has been transferred – obviously this is a fact sensitive defence and depends on analysis of what has actually transferred to Sevco Additionally, any redundancies for a reason connected with the transfer might also be justifiable if it can be shown they were made on economic, technical or organisational grounds entailing changes in the workforce. Not what Green is seeking to argue here at all.

Green could also look for indemnities from the administrator, but if Old Rangers are going into into liquidation, there will be no-one to enforce the indemnities against, so they will not be worth much. The only other “protection” is to ensure that the assets are purchased as cheaply as possible so as to factor in the potential cost of any TUPE claims.

Following Key2Law and the recent decision in Spaceright Europe Limited v Baillavoine (that dismissals can be in connection with the transfer even where no prospective transferor has been identified), the Court of Appeal has confirmed that a dismissal can be automatically unfair under TUPE even if the transfer itself is not in contemplation at the time that the dismissal is effected. In this case the administrators, who intended to sell the business as a going concern, dismissed a number of employees including the claimant. The business was subsequently purchased by Spaceright Europe Limited. The Court of Appeal found that the claimant’s dismissal was automatically unfair because he had been dismissed for “a reason connected with the transfer” and so was automatically unfair. The fact that the dismissal took place in order to achieve a sale at a future date was sufficient.

We can see that these cases deal with the rights of the employee to maintain their careers when the assets of the company are sold from administrators to a newco. These have nothing to do with the forced transfer of an employee to move over to a newco to whom an administrator has sold the assets. It only guarantees their contract if they choose to go over to the purchasing company.

What I dont see eye to eye with Mr McConville over is whether TUPE applies at all to employees that choose to move. I would argue that players under contracts that choose not to go to a new company dont need to rely on TUPE for protection. Furthermore, there are statutory obligations that must occur when transferring employees.

The employee notification process is relatively simple. Under the Employment Act 2002 (Dispute Resolution) Regulations 2004 the transferor employer must provide the new employer with a specified set of information which will assist him to understand the rights, duties and obligations in relation to those employees who will be transferred. This is to ensure the arrival of the transferred employees is a smooth transition and the employees also gain because their new employer is made aware of his inherited obligations towards them. The information in question is:

– the identity of the employees who will transfer; – the age of those employees;

– information contained in the ‘statements of employment particulars’ for those employees;

– information relating to any collective agreements which apply to those employees;

– instances of any disciplinary action within the preceding two years taken by the transferor in respect of those employees in circumstances where the statutory dispute resolution procedures apply or from 6 April 2009 the ACAS Code of Practice on disciplinary and grievance procedures;

– instances of any grievances raised by those employees within the preceding two years in circumstances where the statutory dispute resolution procedures apply or from 6 April 2009 the Acas Code of Practice on disciplinary and grievance procedures; and

The information must be provided in writing or in other forms which are accessible to the new employer.

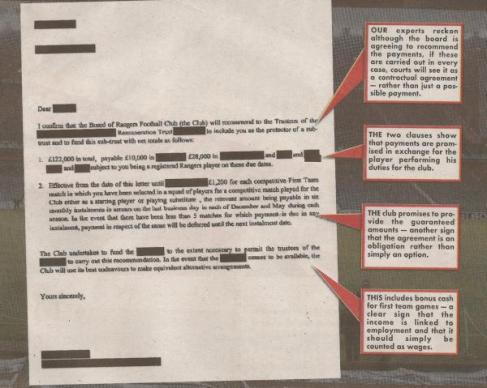

Mr Green should release this letter from D&P.

The Regulations place a duty on both the transferor employer and new employer to inform and consult representatives of their employees who may be affected by the transfer or measures taken in connection with the transfer. Those affected employees might include:

(a) those individuals who are to be transferred;

(b) their colleagues in the transferor employer who will not transfer but whose jobs might be affected by the transfer; or

(c) their new colleagues in employment with the new employer whose jobs might be affected by the transfer.

Long enough before a relevant transfer to enable the employer to consult with the employees’ representatives, the employer must inform the representatives:

• that the transfer is going to take place, approximately when, and why;

• the legal, economic and social implications of the transfer for the affected employees;

• whether the employer envisages taking any action (reorganisation for example) in connection with the transfer which will affect the employees, and if so, what action is envisaged;

• where the previous employer is required to give the information, he or she must disclose whether the prospective new employer envisages carrying out any action which will affect the employees, and if so, what. The new employer must give the previous employer the necessary information so that the previous employer is able to meet this requirement.

Mr Green should release the details of this notification to the players, and if the player is in the union, then their player representatives.

When Mr Green has tried to do is pull a fast one. When he says, “The transfer of contracts has already happened and the club’s clear legal advice is that players’ purported objection is ineffective. Rangers would like to make it abundantly clear to players, agents and the chairmen and managers of other football clubs that we will take whatever steps necessary to challenge what we regard as a breach of contract to protect the interests of our club, ” he is saying he transferred the players over to a newco without notifying the players or the agents. As a Newco is, well, a “newco”, then the players can choose to leave, and Sevco is without any legal authority to sue the players, the agents, or other clubs for remuneration. Those that do transfer over without notification may have a case against Green and Sevco if their contracts aren’t automatically honoured under the original terms for unfair dismissal.

In my humble opinion.

Web3dLaw